Ocity II

Invest in Luxembourg real estate with OCITY II

Fonds ouvert à la souscription

Please fill in this mandatory field.

Please fill in this mandatory field.

Veuillez renseigner un numéro de téléphone valide.

Please fill in this mandatory field.

Veuillez renseigner une adresse email valide.

Please fill in this mandatory field.

Please fill in this mandatory field.

Please fill in this mandatory field.

Please fill in this mandatory field.

Please fill in this mandatory field.

À toutes fins utiles, il vous est rappelé que MIMCO Asset Management est une filiale du groupe MIMCO Capital et qu’elles sont deux entités différentes. La société MIMCO Capital est une société de droit luxembourgeois non régulée qui propose les solutions d’investissement Mercureim EF1, Everest One, BUILDIM 19 et OCITY. Ses fonds sont réservés exclusivement aux investisseurs professionnels au sens de la directive 2014/65/UE - MiFID II. MIMCO Asset Management est née du développement de MIMCO Capital vers la France. MIMCO Asset Management est une société de gestion de droit français régulée par l’AMF sous l’agrément n° GP-21000018, qui gère les fonds MIMCO Grand-Ducal, MIMCO Revitalize et MIMCO Green Value. Par renvoi de l'article L. 214-144 du CMF, ses fonds en cours et à venir sont exclusivement réservés aux investisseurs professionnels et assimilés professionnels en France, répondant aux conditions de l’article 423-27-1 du Règlement général de l’AMF, à savoir ceux susceptibles d’investir au minimum 100.000 EUR. Il est de votre seule responsabilité de connaître et de respecter toutes les législations et réglementations applicables dans la juridiction qui vous concerne en relation avec votre accès à ce site internet. Si vous n'êtes pas certain de pouvoir être considéré comme un investisseur professionnel au regard des lois et règlements en vigueur, vous devriez solliciter le conseil d’un expert indépendant. L’ensemble des contenus de ce site web est fourni uniquement à des fins d’information et ne constitue nullement une offre ou une recommandation d’achat ou de vente de produits ou services financiers quelconques, ni une promesse d’entreprendre ou de solliciter une activité, et ne saurait être considéré comme fiable en relation avec une offre ou une vente quelconque de produits ou services financiers. Les informations figurant sur ce site sont protégées par le droit d’auteur et tous les droits sont réservés. Elles ne peuvent être ni reproduites, ni copiées, ni redistribuées en totalité ou en partie. En cliquant sur « Continuer », vous confirmez à MIMCO Asset Management que vous accédez à ce site en qualité d'investisseur professionnel disposant des connaissances et des compétences nécessaires pour évaluer les risques associés aux investissements dans des produits financiers, de même, vous confirmez que votre utilisation de ce site ne viole aucune loi ou réglementation applicable.

À toutes fins utiles, il vous est rappelé que MIMCO Platform est une filiale du groupe MIMCO Capital et qu’elles sont deux entités différentes. La société MIMCO Capital est une société de droit luxembourgeois non régulée qui propose les solutions d’investissement Mercureim EF1, Everest One, BUILDIM 19 et OCITY. Ses fonds sont réservés exclusivement aux investisseurs professionnels au sens de la directive 2014/65/UE - MiFID II. MIMCO Platform est née du développement de MIMCO Capital vers la France. MIMCO Platform est une société de gestion de droit français régulée par l’AMF sous l’agrément n° GP-21000018, qui gère les fonds MIMCO Grand-Ducal, MIMCO Revitalize et MIMCO Green Value. Par renvoi de l'article L. 214-144 du CMF, ses fonds en cours et à venir sont exclusivement réservés aux investisseurs professionnels et assimilés professionnels en France, répondant aux conditions de l’article 423-27-1 du Règlement général de l’AMF, à savoir ceux susceptibles d’investir au minimum 100.000 EUR. Il est de votre seule responsabilité de connaître et de respecter toutes les législations et réglementations applicables dans la juridiction qui vous concerne en relation avec votre accès à ce site internet. Si vous n'êtes pas certain de pouvoir être considéré comme un investisseur professionnel au regard des lois et règlements en vigueur, vous devriez solliciter le conseil d’un expert indépendant. L’ensemble des contenus de ce site web est fourni uniquement à des fins d’information et ne constitue nullement une offre ou une recommandation d’achat ou de vente de produits ou services financiers quelconques, ni une promesse d’entreprendre ou de solliciter une activité, et ne saurait être considéré comme fiable en relation avec une offre ou une vente quelconque de produits ou services financiers. Les informations figurant sur ce site sont protégées par le droit d’auteur et tous les droits sont réservés. Elles ne peuvent être ni reproduites, ni copiées, ni redistribuées en totalité ou en partie. En cliquant sur « Continuer », vous confirmez à MIMCO Platform que vous accédez à ce site en qualité d'investisseur professionnel disposant des connaissances et des compétences nécessaires pour évaluer les risques associés aux investissements dans des produits financiers, de même, vous confirmez que votre utilisation de ce site ne viole aucune loi ou réglementation applicable.

À toutes fins utiles, il vous est rappelé que MIMCO Capital est une filiale du groupe MIMCO Capital et qu’elles sont deux entités différentes. La société MIMCO Capital est une société de droit luxembourgeois non régulée qui propose les solutions d’investissement Mercureim EF1, Everest One, BUILDIM 19 et OCITY. Ses fonds sont réservés exclusivement aux investisseurs professionnels au sens de la directive 2014/65/UE - MiFID II. MIMCO Capital est née du développement de MIMCO Capital vers la France. MIMCO Capital est une société de gestion de droit français régulée par l’AMF sous l’agrément n° GP-21000018, qui gère les fonds MIMCO Grand-Ducal, MIMCO Revitalize et MIMCO Green Value. Par renvoi de l'article L. 214-144 du CMF, ses fonds en cours et à venir sont exclusivement réservés aux investisseurs professionnels et assimilés professionnels en France, répondant aux conditions de l’article 423-27-1 du Règlement général de l’AMF, à savoir ceux susceptibles d’investir au minimum 100.000 EUR. Il est de votre seule responsabilité de connaître et de respecter toutes les législations et réglementations applicables dans la juridiction qui vous concerne en relation avec votre accès à ce site internet. Si vous n'êtes pas certain de pouvoir être considéré comme un investisseur professionnel au regard des lois et règlements en vigueur, vous devriez solliciter le conseil d’un expert indépendant. L’ensemble des contenus de ce site web est fourni uniquement à des fins d’information et ne constitue nullement une offre ou une recommandation d’achat ou de vente de produits ou services financiers quelconques, ni une promesse d’entreprendre ou de solliciter une activité, et ne saurait être considéré comme fiable en relation avec une offre ou une vente quelconque de produits ou services financiers. Les informations figurant sur ce site sont protégées par le droit d’auteur et tous les droits sont réservés. Elles ne peuvent être ni reproduites, ni copiées, ni redistribuées en totalité ou en partie. En cliquant sur « Continuer », vous confirmez à MIMCO Capital que vous accédez à ce site en qualité d'investisseur professionnel disposant des connaissances et des compétences nécessaires pour évaluer les risques associés aux investissements dans des produits financiers, de même, vous confirmez que votre utilisation de ce site ne viole aucune loi ou réglementation applicable.

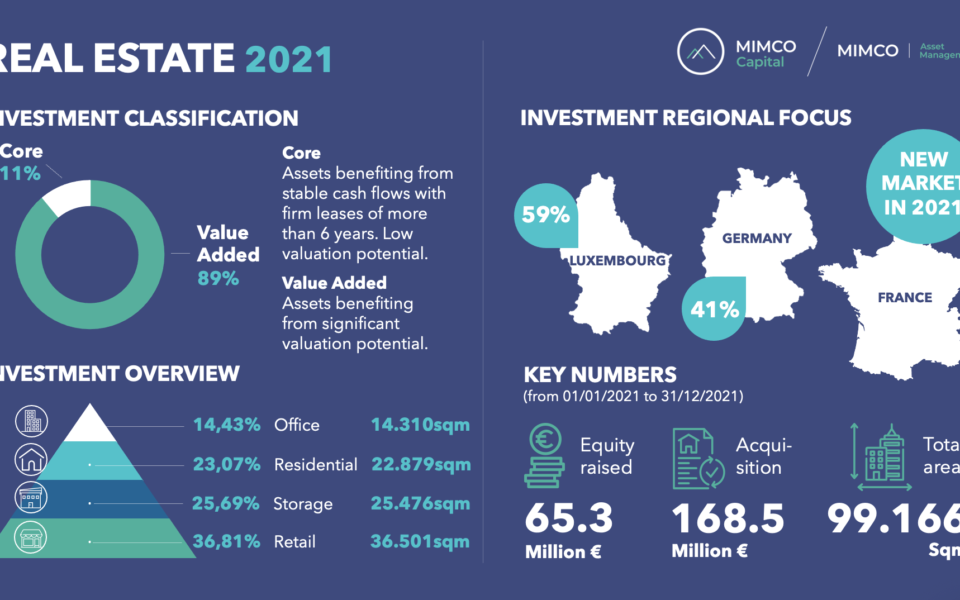

The MIMCO Group continues its development and highlights its key real estate indicators for the year 2021, placed under the sign of a very positive annual balance sheet supported by a fully controlled organizational structure.

The MIMCO group continued its strong momentum by recording an acquisition volume of more than 168 million euros in financial year 2021.

The group also acquired more than 99,000 sqm of space in 2021 and raised more than €65 million from its historical shareholders and new investors in Europe.

"These figures confirm the group's very good dynamism, which has recorded a fifth consecutive year of activity with excellent results. We also see an increase in the second half of the year, with the creation of our SGP in Paris in May 2021. We expect 2022 to be a new stage of growth, notably with ongoing investments on behalf of our 6 funds as well as the launch of new strategies in the coming months, in addition to our recent focus on the French market," explains Christophe Nadal, co-founder and CEO of MIMCO Capital and MIMCO AM.

The year 2021 has also seen a strong jump in value-added investments, benefiting from a significant valuation potential. While core assets, with stable medium- to long-term cash flows, accounted for 11% of investments, value-added operations with higher potential for capital gains represented 89% of the volume invested, confirming the group's investment strategy.

Ara Adjennian, Managing Director and Partner of MIMCO AM said: "With the creation of MIMCO AM in Paris, the group's objective was to open up to the French value-added market, which has one of the largest real estate markets in Europe. Thanks to the expertise of our teams in this area, operations in exceptional strategic locations are being finalized on the outskirts of the Parisian capital for the first half of 2022. This confirms the soundness of our investment strategy and the relevance of our real estate convictions."

However, while in previous years most investments were concentrated in retail and office properties, in 2021 the focus was on storage (25.69%) and residential (23.07%), slightly behind retail (36.81%), which continues to dominate. Office space, meanwhile, was invested this year at 14.43% (-26% compared to 2020).

"We have focused our development significantly on residential and warehousing, in line with the investment strategy of our various funds focused on real estate in Luxembourg as well as our new club-deals focused on logistics." The year 2020 had voluntarily seen a significant increase in its investments in the Grand Duchy of Luxembourg.

"The share of our investments in the restructuring of obsolete offices in Germany remains similar," says Bernd von Manteuffel, co-founder and CEO of MIMCO Capital.

"At the end of a year that was particularly affected by the health crisis, the group's balance sheet is very dynamic, confirming the strong resilience of our model. The valuation of assets and operations in progress over the last twelve months reached more than 530 million euros as of December 2021," explains Christophe Nadal. "With the perspective of a more serene 2022, we are particularly confident in our ability to develop new qualitative projects to best meet the expectations of our investors." See you at the end of 2022 for the review!

Thank you to all our partners, shareholders and employees for their commitment and their constantly renewed confidence.

MIMCO Group announces the acquisition of the Conde Redondo real estate project, located in the heart of Lisbon’s sought‑after Santo António district. This conversion of an office building into a serviced residence aligns with the Group’s ongoing pan‑European development strategy.

Announcement

MIMCO and Foncière Renaissance announce the acquisition of the building located at 48 rue Notre‑Dame des Victoires, in the 2nd arrondissement of Paris, opposite Palais Brongniart and in the heart of the Opéra Central Business District.

Announcement

Watch Charlotte Habib, Responsable des partenariats Île‑de‑France et Grand‑Est, and Christophe Coutteau, Business Development Director at MIMCO Asset Management, on the Club Patrimoine set.

News

MIMCO will be present in Cannes from March 10 to 14, 2025, for MIPIM 2025, the largest real estate trade fair in France.

News